Psychiatry and psychotherapy for the whole person.

Payment and Insurance

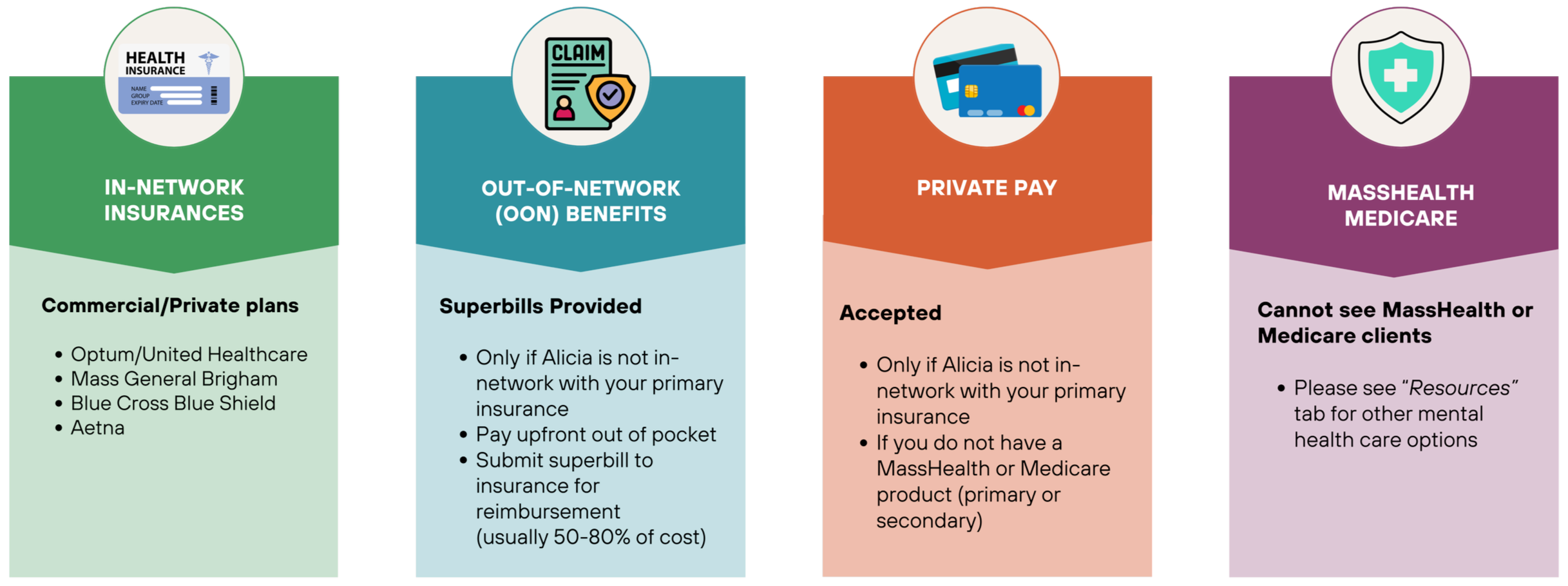

In-Network Insurances

Alicia is currently in-network with the commercial/private plans of:

Blue Cross Blue Shield (BCBS)

Indemnity: Master Health Plus; Comprehensive Major Medical; Medex

PPA: Blue Care Elect; Preferred Blue PPO

HMO Blue: HMO Blue; Network Blue; Blue Choice; Access Blue; HMO Blue New England; Managed Blue for Seniors

Optum

United Healthcare/United Behavioral Health (UBH)

Mass General Brigham: HMO; Employees

Aetna

Standard: Open Choice PPO; Managed Choice POS; HMO; QPOS; Affordable Health Choices; Select

Open Access: Choice POS II; Health Network Only; Health Network Option; Select; Elect Choice EPO; Managed Choice POS; North Carolina State Health Plan

Health Fund: Choice POS II; Open Access Elect Choice EPO; Open Access Managed Choice POS; Open Access Aetna Select; Open Choice PPO

Some insurance plans contract with a separate company, a “behavioral health administrator”, that manages your mental health and psychiatric services. When considering insurance coverage, please check to see who manages your behavioral health services.

Alicia is considered to be in-network if she is in-network with your behavioral health administrator, even if she is not in-network with your primary health insurance (see FAQ’s).

Don’t see your insurance? Join the insurance waitlist & indicate your current insurance provider so that Alicia knows which insurances to consider joining.

Out-of-Network Benefits

If Alicia is not in-network with your primary insurance/behavioral health administrator, you can check to see if your primary insurance offers out-of-network (OON) benefits - usually this occurs with “PPO” insurance products (see FAQ’s). If so, you will need to pay out-of-pocket upfront. After the appointment, Alicia will provide you with a superbill, which you can submit to your insurance for potential reimbursement (often around 50%-80% of the session’s cost).

Private Payment

You are welcome to pay for Alicia’s services out-of-pocket as long as Alicia is not in-network with your primary insurance AND you do not have a MassHealth or Medicare product as your primary or secondary health insurance (see FAQ’s if you’re not sure).

MassHealth/Medicare

Alicia is not currently in-network with MassHealth (Medicaid) or Medicare products at this practice.

No Private Pay: Due to federal and state regulations, many out-of-network clinicians are not allowed to accept private payment from individuals with MassHealth or Medicare (including as a secondary insurance).

No Out-of-Network Benefit Reimbursements: Due to federal and state regulations, services cannot be reimbursed via OON benefits.

As a result, if you have a MassHealth or Medicare plan—whether as your primary or secondary insurance—Alicia is unfortunately unable to provide care at this time. We recommend seeking services from a provider who is in-network with your plan (see Resources page).

Payment/ Insurance FAQ’s

-

Figuring out if you have primary/secondary insurances or MassHealth/Medicare, and who covers your behavioral health services:

Call your insurance plan(s) (use the number on the back of your insurance card) and ask:

(If you’re not sure if you have more than one insurance, or which is primary or secondary)

Do I have more than one health insurance plan on file?

Which one is my primary and which one is my secondary?

Are either my primary or secondary insurances a MassHealth (Medicaid) or Medicare product?

Does my insurance company manage behavioral health services directly, or is it managed by another company?

What is the name of that behavioral health provider or subcontractor and how could I contact them?

Once you’ve identified which company covers your behavioral health services, call them and ask them:

Are psychiatric medication management and/or psychotherapy, provided both in-person and via telehealth covered when provided by this practice:

Alicia S. Yeung, DNP, PMHNP, PLLC

NPI 2: 1083500706

Do I need any prior authorizations or referrals?

What will my out-of-pocket costs be in terms of my:

Copay

Deductible

Co-insurance

If Alicia is not in-network with your primary insurance/behavioral health contractor, ask your primary insurance:

Do I have out-of-network benefits for outpatient psychiatric and psychotherapy services — both in-person and via telehealth?

What is my annual out-of-network deductible and how much remains?

After I meet my deductible, what percentage of each session will be reimbursed?

Specifically, how much will I be reimbursed for the following CPT codes?

Initial Evaluation: 90792 or 99204/99205, possibly with 90833 or 90836

Psychotherapy Only: 90834 or 90837

Medication Management Only: 99213, 99214, or 99215 (depending on complexity)

Combined Medication Management + Psychotherapy: 99213, 99214, or 99215 plus 90833, 90836, or 90838 (depending on session length)

We encourage you to document these conversations, including the name of the representative you speak with, the date, and any confirmation numbers or notes.

-

Even when a provider is in-network, your health insurance plan may still require you to pay out-of-pocket costs such as a deductible, copayment, or coinsurance. These are determined by your specific insurance policy, not by Alicia.

A deductible is the amount you must pay out-of-pocket each year before your insurance starts covering services. This means that if you haven't met your deductible yet for the year, you're responsible for paying the full contracted rate for sessions until the deductible is met—even if Alicia is in-network.

Most deductibles reset annually, typically on January 1st or July 1st. Be sure to mark your calendar with this date to avoid unexpected costs.

A copay is a fixed amount you pay for each visit, as specified by your plan.

Coinsurance is a percentage of the cost of services that you’re responsible for, even after meeting your deductible.

For the most accurate information about your mental health benefits and current deductible status, it's best to contact your insurance provider directly.

-

To find out if your plan uses a third-party behavioral health administrator, you can:

Check the back of your insurance card – Look for a separate phone number or a note about behavioral/mental health services.

Call your insurance company – Ask who manages your behavioral health benefits (your main insurer or another company).

Log into your insurance portal or review your plan documents – Look for mentions of a separate company managing therapy or psychiatry.

Here are examples of common behavioral health administrators (as of August 2025):

OPTUM

UnitedHealthcare (most plans): Optum is the behavioral health administrator for the majority of UnitedHealthcare plans.

Mass General Brigham Health Plan (MGBHP): Optum manages the behavioral health benefits for most MGBHP commercial (HMO) plans and MGBHP Employee plans.

Student Health Plans: Optum manages many university-sponsored plans, such as those under UnitedHealthcare Student Resources.

BLUE CROSS BLUE SHIELD OF MASSACHUSETTS (BCBSMA)

In-house management: in most cases, BCBSMA manages its own behavioral health benefits and network.

AETNA

In-house management: in most cases, Aetna manages its own behavioral health benefits and network

Meritian Health: Aetna provides its behavioral health provider network to Meritian Health plan

CARELON BEHAVIORAL HEALTH (formerly Beacon Health Options)

MassHealth: Carelon manages the behavioral health benefits for most MassHealth-related products, often through the Massachusetts Behavioral Health Partnership (MBHP).

Wellpoint Massachusetts: Carelon administers behavioral health and substance use services for all Wellpoint Massachusetts members.

Anthem: This includes some out-of-state Blue Cross Blue Shield plans that utilize Anthem and, in turn, contract with Carelon for behavioral health services.

Some Employer-Sponsored Plans: Carelon also serves a number of employer-sponsored plans.

POINT32HEALTH

Harvard Pilgrim Health Care (commercial plans): Managed directly by Point32Health.

Tufts Health Plan (commercial and ConnectorCare plans): Managed directly by Point32Health.

EVERNORTH

Cigna commercial plans: Evernorth is the behavioral health administrator for Cigna's commercial plans.

-

You might have both primary and secondary insurance if:

You’re a minor covered by both parents’ insurance plans

You have your own plan and are also covered under your spouse’s plan

You have Medicare and another plan (such as employer or retiree coverage, from either yourself or your spouse)

You have both Medicare and MassHealth (Medicaid)

You’re a U.S. veteran with both VA benefits and another insurance plan

You’re using COBRA coverage along with a new plan after changing jobs

To check if you have both types of coverage, look at your insurance cards—they may say “Primary” or “Secondary.”

You should also call the customer service number on the back of each of your insurance card(s) and check (see first FAQ on verifying if Alicia is in-network).

-

MassHealth is the Medicaid program for Massachusetts. You might have MassHealth if:

You receive health coverage through a state program or applied through MA Health Connector.

You have a MassHealth insurance card, often blue and white, that says “MassHealth” on it.

Your income qualifies you for low- or no-cost health insurance.

Your plan’s name shows up in the most recent MassHealth Enrollment Guide.

MASSHEALTH PLANS (as of 2025)

WellSense Health Plan

WellSense Care Alliance (ACO)

WellSense Beth Israel Lahey Health (BILH) Performance Network ACO (ACO)

WellSense Community Alliance (ACO)

WellSense Mercy Alliance (ACO)

WellSense Boston Children’s ACO (ACO)

WellSense Essential (MCO)

Tufts Health Together

Tufts Health Together (MCO)

Tufts Health Together with UMass Memorial Health (ACO)

Tufts Health Together with Cambridge Health Alliance (CHA) (ACO)

Mass General Brigham Health Plan

Mass General Brigham Health Plan with Mass General Brigham ACO

Fallon Health

Fallon 365 Care (ACO)

Berkshire Fallon Health Collaborative (ACO)

Community Care Cooperative (C3)

Community Care Cooperative (C3) (ACO)

Be Healthy Partnership

Be Healthy Partnership Plan (ACO with Signature Healthcare and Southcoast Health)

Other MassHealth Programs and Plans

PCC Plan (Primary Care Clinician Plan)

Senior Care Options (SCO)

Program of All-inclusive Care for the Elderly (PACE)

One Care

MassHealth Fee-for-Service

If you're still not sure, call the number on the back of your insurance card to ask or contact MassHealth Customer Service at (800) 841-2900.

-

Medicare is a federal health insurance program primarily for people age 65 or older, or those with certain disabilities or health conditions (such as end-stage renal disease). If you have Medicare, your plan may be either:

Original Medicare, provided directly by the federal government, or

A Medicare Advantage Plan (Part C), provided by a private insurance company (such as Aetna, Blue Cross Blue Shield, UnitedHealthcare, or Mass General Brigham Health Plan).

You might have Medicare if:

You have a red, white, and blue Medicare card with your name and a Medicare number

You’re over age 65 or receiving Social Security Disability Insurance (SSDI)

You see deductions labeled “Medicare Premium” on your Social Security check or bank statement

You have a private insurance card that mentions “Medicare Advantage,” “Medicare HMO,” “Medicare PPO,”“Part C”, or “Senior”

MASSACHUSETTS MEDICARE PLANS (as of 2025)

Aetna Medicare

Aetna Medicare Advantage (HMO)

Aetna Medicare Prime (HMO-POS)

Aetna Medicare Premier (PPO)

Aetna Dual Eligible Special Needs Plans (D-SNPs)

Blue Cross Blue Shield of Massachusetts

Medicare PPO Blue PlusRx

Medicare Advantage PPO

Commonwealth Care Alliance (CCA)

CCA Senior Care Option (HMO SNP)

CCA One Care (HMO SNP)

eternalHealth

eternalHealth Forever HMO

eternalHealth Freedom PPO

eternalHealth Give Back PPO

eternalHealth Horizon HMO

Fallon Health

Fallon Medicare Plus (HMO)

Fallon Navicare (HMO SNP)

Mass General Brigham Health Plan

Mass General Brigham Medicare Advantage (HMO-POS)

Mass General Brigham Medicare Advantage (PPO)

Tufts Health Plan

Tufts Medicare Preferred (HMO)

Tufts Medicare Preferred (PPO)

UnitedHealthcare

AARP Medicare Advantage from UHC (HMO-POS)

UnitedHealthcare Senior Care Options (HMO D-SNP)

Wellcare

Wellcare No Premium (HMO)

Medicare Supplement (Medigap) Plans

In Massachusetts, Medigap plans are standardized into three types. The names of the plans themselves are consistent, but the insurance company offering them will be different.

Core Plan

Supplement 1A Plan

Supplement 1 Plan

If you’re still confused, you can verify if you have Medicare by:

Calling Medicare at 1-800-MEDICARE (1-800-633-4227)

Check your status online Medicare.gov

Contacting your insurance plan

-

Self-Pay: If your primary insurance is not an insurance that Alicia is in-network with and you do not have a MassHealth or Medicare product as either your primary or secondary insurance, you may choose to pay out-of-pocket for services with Alicia.

Out-of-Network (OON) Benefits: If Alicia is not in-network with your primary insurance, you may contact them to ask whether your plan includes out-of-network benefits that could help cover part of the cost of services with Alicia (see first FAQ about verifying OON Benefits). Oftentimes, if your plan does include OON Benefits, you can be reimbursed 50-80% of the cost of the session.